Mergers’ Impact on Other Businesses

by Sovina Vijaykumar

Mergers and acquisitions (M&A) are common in business. Companies merge to grow their operations and expand their market share. However, M&A can significantly impact employees and other stakeholders. In this blog, we will explore the positive and negative effects of business mergers on other businesses and provide a real-life example of a recent M&A.

Positive Effects:

Increased Competition:

Business mergers can lead to increased competition in the market. The combined entity may have more resources, expertise, and bargaining power, which can push other businesses to innovate, improve their products or services, and offer better prices to stay competitive.

New Opportunities:

Mergers can create new opportunities for other businesses to collaborate, partner, or supply to the merged entity. For example, a supplier may now have access to a larger market through the merged entity, increasing sales and revenue.

Boost to the Economy:

Mergers can positively impact the economy by creating jobs, generating taxes, and increasing consumer spending. The combined entity requiring more resources and infrastructure can result in employment growth and economic development.

Improved Market Stability:

Mergers can bring stability to the market by reducing competition and eliminating duplication of resources. The result can be a better allocation of resources, improved profitability, and a more stable business environment.

Negative Effects:

Reduced Competition:

Mergers can reduce competition in the market, leading to increased prices, reduced quality, and decreased innovation. Lesser options in the market can negatively impact consumers, smaller businesses, and suppliers.

Job Losses:

Mergers can result in job losses as the combined entity may streamline operations, reduce redundancies, or outsource some functions. It can negatively affect employees and lead to economic hardship in affected communities.

Supplier Squeeze:

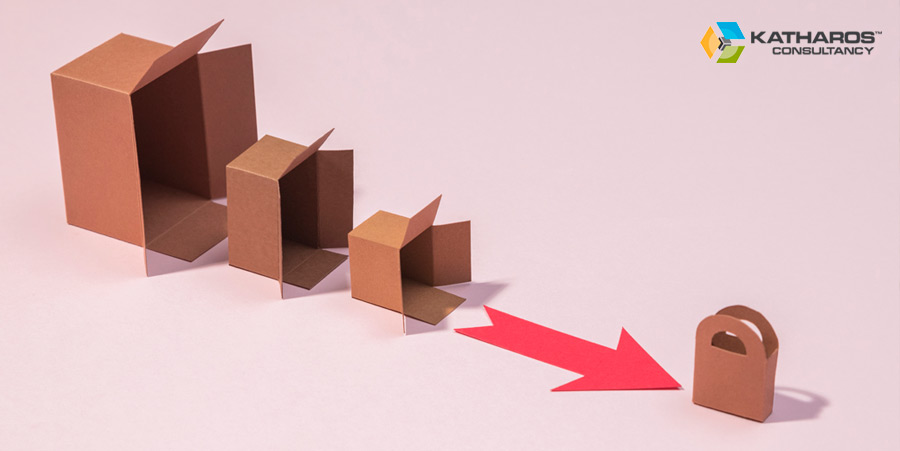

Mergers can consolidate suppliers, giving the merged entity more bargaining power. It can cause lower costs for the merged company but hurt suppliers, who may need to lower their prices and profit margins.

Uncertainty:

Mergers can create market uncertainty, causing reduced investment, lower consumer confidence, and volatility.

Real-life Example:

In 2023, the pharmaceutical giant Pfizer acquired the biotech company Medivation for $14 billion. This merger had a significant impact on other businesses in the industry. The positive effects included increased competition, as the merged entity now had a stronger position in the market and a portfolio of products. The merger also created new opportunities for suppliers and partners to collaborate with the combined entity.

However, there were adverse effects as well. The merger led to job losses as Pfizer streamlined operations and eliminated redundancies. The impact extended beyond Pfizer and Medivation employees to those in neighboring communities. The acquisition also caused uncertainty, as investors and customers had questions about the future direction of the merged company.

Reference: https://www.pfizer.com/news/press-release/press-release-detail/pfizer-acquire-medivation

Conclusion:

Mergers can impact other businesses in the industry, both positively and negatively. Positive effects of mergers include increased competition, new opportunities, and a boost to the economy, while adverse effects include reduced competition, job losses, and uncertainty. Companies considering mergers should carefully assess the potential impact on other businesses and stakeholders and take steps to mitigate adverse effects. Understanding the consequences of mergers can help companies make informed decisions and minimize risks.